The Invisible Consequences of Cryptocurrency Market Volatility

In the ever-changing landscape of cryptocurrency market trends, traders are constantly looking for new strategies to navigate uncertainty. At the heart of these strategies is the concept of orders, which can be broadly divided into two types: stop orders and limit orders.

A

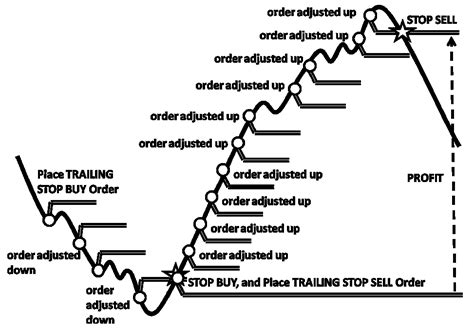

stop order is an instruction to sell a security when it falls below a predetermined price level, with the goal of limiting losses or locking in profits before they are realized. It is essentially a “sell” signal that triggers a trade to exit the market at the current price. Stop orders can be placed before, during, or after trading hours, and their effects are felt immediately.

In contrast,

limit orders

are more nuanced. They allow traders to set an entry price for a security in the hopes of buying low and selling high. Limit orders can be set at various price levels, including market support and resistance points, which can help prevent significant price fluctuations. The main difference between stop and limit orders is that they do not automatically trigger a trade when reached; instead, the order is only executed when the market price reaches the specified entry or exit point.

Now let’s dive into the world of supply chain management. Imagine you are a logistics company responsible for shipping goods from Asia to Europe. Your costs can be affected by various factors, including exchange rates, fuel prices, and global demand. To mitigate these risks, you could hedge your supply chain with

swap contracts that allow you to lock in a price for future deliveries.

For example, you could enter into a swap contract that guarantees a certain amount of currency at the same time next year. This ensures that your cash flows from Asia match those from Europe when exchange rates are favorable. By securing your supply chain, you can reduce your exposure to volatility and make more informed decisions about where your goods are delivered.

In the context of cryptocurrency trading,

stop-loss orders can help limit losses by automatically selling a security at a predetermined price when it falls below a certain level. This strategy can be particularly useful for traders who have invested heavily in a particular asset, as it allows them to limit their losses and avoid significant price declines.

However, stop-loss orders can also have unintended consequences. If the market suddenly experiences a price increase, the trader may need to cover their position at a loss by selling a security that is higher than their desired exit point. This can result in significant losses for the trader as well as damage to their reputation within the trading community.

To mitigate these risks, traders should carefully consider their stop-loss levels and adjust them according to market conditions. It is also important to have a solid understanding of the underlying assets and markets to make informed decisions about hedging strategies.

In summary, while cryptocurrency markets are inherently volatile, traders can use various tools, including stop orders and limit orders, to circumvent these risks. By controlling their exposure through appropriate hedging strategies, traders can better manage their positions and minimize losses. However, it is crucial that traders remain vigilant and adapt to changing market conditions to stay one step ahead.

ETHEREUM DOES BINANCE SWIFT CLOSED