Here’s a summary of the article “Overcoming FOMO in Volatile Markets” for you:

Understanding Fear-of-Money (FOMO) and its impact on trading

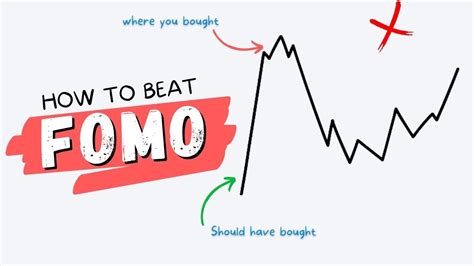

Fear-of-money, or FOMO, is a psychological phenomenon where individuals fear missing out (FMO) on investment opportunities due to concerns about market volatility. This anxiety can lead people to make impulsive decisions, which may result in financial losses.

How FOMO affects trading behavior

When markets are volatile, people tend to:

- Sell more stocks, bonds, and other investments

- Buy more riskier assets (e.g., cryptocurrencies)

- Trade more frequently

These actions can lead to increased transaction costs, reduced liquidity, and higher risks.

Strategies to overcome FOMO in volatile markets

To manage FOMO in volatile markets, traders can employ the following strategies:

- Risk management: Set stop-loss orders, limit position sizes, and use position sizing techniques to minimize losses.

- Diversification: Spread investments across different asset classes, sectors, and geographic regions to reduce exposure to individual market movements.

- Position sizing

: Use a safe-haven approach by allocating more capital to low-risk assets (e.g., bonds) and reducing the allocation to higher-risk assets.

- Stress-testing: Regularly test trading strategies against potential market scenarios to identify weaknesses and adjust your approach accordingly.

- Emotional control: Practice self-control by setting boundaries, avoiding impulsive decisions, and focusing on long-term goals.

Conclusion

Overcoming FOMO in volatile markets requires a combination of risk management techniques, diversification, position sizing, stress-testing, and emotional control strategies. By understanding the psychology behind FOMO and implementing these strategies, traders can reduce their anxiety and make more informed investment decisions.

Do you have any specific questions about this article or trading in general? I’m here to help!