“Fantoma Frenzy: Understanding the Cryptocurrency Boom and Fundamental Analysis for Long-Term Growth”

As the cryptocurrency world continues to evolve at an unprecedented pace, investors are looking for more than just quick profits. They are looking for long-term growth, stability, and a clear understanding of what determines market value. In this article, we delve into the world of crypto, examining two key concepts: Fantom (FTM) and Fundamental Valuation.

What is Crypto?

Cryptocurrency has become an integral part of the global financial world, with thousands of digital assets traded on major exchanges around the world. Essentially, cryptocurrency is a decentralized digital currency that uses cryptography to secure transactions and control the creation of new units. The most well-known cryptocurrency is Bitcoin (BTC), but there are countless other cryptocurrencies, each with unique features and use cases.

Fantom (FTM): A New Player in Crypto

In recent years, Fantom has become a major player in the crypto space. Founded by Anthony Di Iorio, Fantom was first launched in 2017 and has since become one of the fastest-growing cryptocurrencies on the market. Fantom is distinguished from other cryptocurrencies by its unique architecture: it uses a staking consensus algorithm that allows for faster transaction times and lower energy consumption compared to traditional proof-of-work algorithms.

Fantom’s tokenomics are designed to incentivize investment and provide liquidity, making it an attractive option for holders. The cryptocurrency has gained significant traction among traders and investors due to its fast transaction speeds, low fees, and high liquidity. Fantom has partnered with several prominent companies, including IBM and Alipay, further strengthening its position in the market.

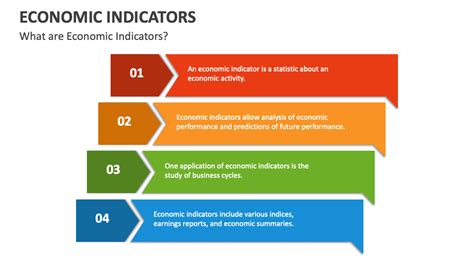

Economic Indicators: Key to Valuation

When evaluating the value of a cryptocurrency like Fantom, it is essential to consider economic indicators that provide insight into broader market conditions. Here are some notable indicators:

- Inflation Rate: Inflation can have a significant impact on cryptocurrency prices. When inflation is high, investors tend to sell their assets, which drives prices down. Conversely, when inflation is low, investors may hold on to their assets, which drives prices up.

- Interest Rates: Changes in interest rates can also affect cryptocurrency prices. Lower interest rates can lead to increased purchasing power and higher prices for cryptocurrencies with higher liquidity costs.

- GDP Growth: Strong GDP growth can increase demand for digital assets, which can lead to price appreciation.

- Employment Rate: A high employment rate can indicate a growing economy, which can contribute to the price of cryptocurrencies.

Fundamental Valuation: What It Means

Fundamental valuation is the estimation of the intrinsic value of a cryptocurrency, rather than based on market sentiment or speculation. This approach involves analyzing various economic indicators and evaluating the fundamentals of the asset. Here are some key factors to consider when conducting fundamental analysis:

- Market Cap

: The total market cap of a cryptocurrency determines its liquidity and market size.

- Token Price: A low token price may indicate that investors are undervaluing the asset, while a high token price may indicate strong sentiment.

- Development Roadmap: A clear development roadmap can give confidence in the asset’s future growth prospects.

- Community Support: Strong community support and engagement can contribute to increased demand for cryptocurrencies.

Conclusion

Fantom (FTM) has become a major player in the crypto space, offering a unique blend of speed, low fees, and high liquidity.