The future of storage with aave and risk reward proportions

The cryptocurrency has long been an interesting topic for many investors, merchants and Staker. One of the most exciting developments in the cryptocurrency area is the decentralized financial (defi) platforms, including Aave, which revolutionizes the way we think about the headquarters and risk management.

What is your seat?

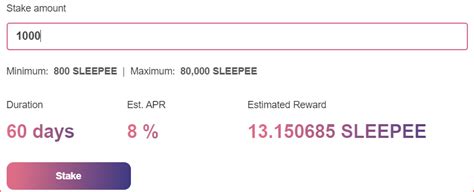

The cargo is a process that allows users to keep their cryptocurrencies for a certain period of time, in the form of new coins or tokens to obtain interest or rewards. In conventional storage models, such as bitcoin, users certify coins as part of a network and in return they receive some of the transaction fees. However, there are limits to this model, as it relies on the trust of the node operators that can change over time.

AAVE: Decentralized Storage Platform

AAVE is a decentralized lending platform that allows users to reward their cryptocurrencies while offering a safe and user -friendly way to gain interest. Launched by Yissak Co. in 2016, Aave is the largest defi platform in the Ethereum blockchain, with more than $ 1 billion in daily trading volume.

The AAVE storage model is based on a token called AAVE (Avalanche), which is used to encourage users to coin. When a user collects AAVE, some of the transaction fees are received from other users. This creates a decentralized and unreliable environment where users can gain reward without relying on any central power.

Risk-benefit ratios

One of the most significant benefits of the AAVE storage model is the risk-benefit ratio. By formulating the coins, users gain a higher reward than traditional storage models. The reason for this is that AAVE offers a fixed interest rate for stacked tokens, which can be up to 20% per year, while other defi platforms can offer lower rewards.

However, this also means that users need to take more risk when placed in the platform. If the price of the AAVE is the price, the user’s reward decreases accordingly. This is called “leverage” effect, where the user’s loss for investors with them.

Aave benefits

Aave offers many benefits that make users attractive:

- decentralized and unreliable : AAVE is based on a decentralized blockchain, which means there are no central authorities that control the platform or its rewards.

- High Rewards : The AAVE storage model provides high rewards for stakers, providing an attractive opportunity for users looking for a high return on their investments.

- Low -Risk

: Investing in AAVEA can earn interest rate without taking a significant risk as the reward is recorded and guaranteed on the platform.

Conclusion

Aave revolutionized the way we think of risk management and risk management in cryptocurrencies. Its decentralized and unreliable model provides users a safe environment to gain reward without relying on any central power. While AAVE offers high rewards, there is a degree of risk that users have to deal with.

As the Defi Square develops further, AAVE is in a good position to remain at the forefront of the revolution. With its innovative storage model and low -risk reward structure, AAVE has been one of the most promising platforms of cryptocurrency investors.

Important risks

While Aave offers many benefits, users should be aware of the following risks:

- Price deposit : The price of AAVE can fluctuate significantly, which means that rewards may fall if the market moves against the user.

- Liquidity Risk : If a significant number of users hold the coins, there is a liquidity risk, as there may not be enough buyers to absorb any loss if prices fall.

3.